Table of Contents

Urgent monetary conditions can arise at any time and affect everyone. Whether it’s a surprising medical bill, unexpected home repairs, or some other fee, it’s important to realize you have borrowing options. The most famous alternatives in India are personal loans and private lines of credit. But what sets them aside, and which one might be the proper fit for your desires? Let’s break it down.

What is a personal loan?

An instant personal loan from local money lenders is a straightforward option.. You get a singular amount from a loan specialist and reimburse it in consistent month-to-month portions over a foreordained period (the home loan term). IndusInd Bank is one such loan specialist that offers forceful side interest rates, quick endorsements, and a computerized application framework. As this instant loan online by IndusInd Bank is unstable, you don’t have to give security.

Pros and cons of personal loans

Pros

- Versatile use: Fund a variety of expenses

- No collateral requirement: No need to provide any asset as collateral

- Fast approval: Often receive funds without much delay

Cons

- Potentially higher interest: Especially if your credit score is on the lower end

- Fees: May include origination or prepayment fees

- FICO assessment influence: Late or missed instalments adversely influence your score

What is a personal line of credit?

An individual credit extension offers greater adaptability. Imagine it like a credit card with a higher limit. You are approved for a maximum amount and can withdraw funds up to that limit repeatedly as needed. You only pay interest on what you withdraw, and your available credit replenishes as you repay.

Pros and cons of personal lines of credit

Pros

- Flexibility: Borrow and repay as needed up to your limit

- Pay interest only on what you use: Potentially lower costs

- Credit building potential: Responsible use can improve your credit score

Cons

- Variable interest rates: Payments can fluctuate with market changes

- Fees: Some lines of credit might have annual or inactivity fees

- Stricter eligibility: Excellent credit and financial history may be required to qualify

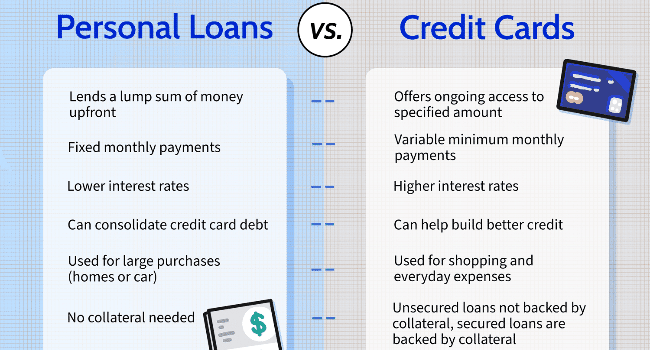

Difference between a personal loan and a personal line of credit

| Feature | Personal loan | Personal line of credit |

| Funding | Lump sum disbursement | Withdraw as needed up to the credit limit |

| Interest | Charged on the entire borrowed amount | Charged only on the amount you use |

| Interest rate type | Usually fixed | Usually variable |

| Suitability | Best for one-time, well-defined expenses | Best for ongoing or unpredictable expenses |

Which is right for you?

The choice between an individual credit and an individual credit extension relies upon your particular monetary conditions and objectives. Here is a breakdown to assist you with picking:

Go for a personal loan if:

- You need a specific amount for a one-time cost, together with a medical bill, domestic development venture, or wedding. An online mortgage offers a clean image of your general reimbursement responsibility, making budgeting less difficult.

- You select the steadiness of constant monthly bills. With a non-public loan, your interest charge and repayment amount are locked in for the complete loan period, allowing for less complicated economic planning.

Choose a personal line of credit if:

- You have ongoing or recurring costs that can be hard to expect, including car upkeep or home protection. A non-public line of credit score offers flexibility as you can borrow only what you want, up on your credit restriction.

- You can manipulate your debt strategically. With a line of credit, you could make interest-only payments for the draw duration, minimizing your month-to-month outgoings. Remember that the most important thing is still due at the end of the term.

Bottom line

Before opting for a non-public mortgage or line of credit, compare hobby charges and phrases from distinct lenders. Remember that Indian laws and guidelines govern those monetary merchandise, so recognize the best print before signing any settlement.

Read more on kulFiy