Table of Contents

Americans Overpay Billions of Dollars in Interest

As consumers, we love to spend time comparing every detail about the things we buy. On average,

- We spend 124 hours comparing an average of 19 homes.

- We invest more than 14 hours researching a new vehicle.

- We spend on average up to 20 hours to plan a week’s vacation.

It is smart to take your time and analyze your options when making a large purchase. However, the same can’t be said about the way we compare the financing options for those purchases.

Granted. The reason we spend so much time geeking out over specs and features is that we enjoy planning and thinking about our next vehicle, home, or vacation. But failing to show similar enthusiasm in the rates and terms of the loans we use to finance our purchases is costing us.

Not comparing lenders is an expensive mistake

For most homebuyers, the mortgage shopping process stops after their first application. A study by the Consumer Finance Protection Bureau reported that 77 percent of homebuyers only applied to one lender. However, comparing multiple lenders on a typical $250,000 mortgage would save the average buyer up to $3,900.

A recent survey by the Federal Reserve reported that 76.1 percent of car buyers negotiated the purchase price with the seller, but only 31.6 percent negotiated the interest rate on their loan. Failing to compare several auto lenders causes the average car buyer to pay an interest rate that is 1.3 percentage points higher than the best rate available, according to a 2017 study. In other words, most borrowers pay more than they need to just because they don’t know they have better offers available.

We also find this trend in the unsecured personal loans sector. People tend to go with the first lender that approves their loan. This is a big deal.

The price dispersion of personal loans

In 2019, Americans held a balance of $148 billion in personal loans. Even a modest variation in interest rates could have a significant impact on the debt of American consumers. To illustrate, let’s assume that $148 billion balance has an average term of 36 months and a 13.5 percent APR. Dropping the average APR by only 3.5 percentage points to 10 percent would save Americans $3 billion a year.

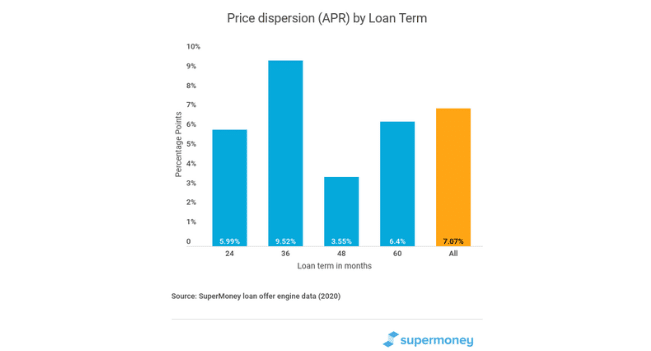

A recent study by SuperMoney, a financial services site, analyzed nearly 160,000 loan offers to over 15,000 borrowers who recently applied for a loan. It found that the average difference between the highest and lowest APR offer (for the same borrower and loan term) was 7.1 percentage points.

The potential savings on even modest loan amounts are huge when the range of rates is so broad. Consider one borrower in the study’s dataset that had a credit score of 720 and applied for a $30,000 loan with a 36-month term. The lowest APR offered was 5.99 percent APR and the highest was 15.87 percent. This price dispersion on a $30,000 loan translates into savings of up to $5,050 — or 17 percent of the loan balance.

It is worth emphasizing again that this price dispersion is for loan offers to the same consumer.

Comparing multiple lenders when shopping for a personal loan is a smart idea no matter what your credit score is. However, the study showed that borrowers with fair (580–669) and good credit (670–739) had the most to gain from comparing multiple lenders. Both credit score brackets had a price dispersion of 8 percentage points.

That does not mean that comparing lenders is not important when you have excellent credit. According to the same SuperMoney study, failing to compare multiple lenders could save borrowers with very good credit more money than increasing their credit score by 100 points.

The problem

Every year, Americans waste billions of dollars on inflated interest rates. Many borrowers only check one or maybe two lenders.

There are several reasons for this. For starters, applying for multiple loan quotes is tedious and time-consuming. Borrowers often think it is a waste of time to compare prices because they assume all lenders have similar rates for people with their credit score.

Some also worry that applying for multiple loans will hurt their credit score. They are not wrong. Every time you get a hard pull on your credit report, your credit score will probably drop by a few points.

The solution

The good news is that many lenders allow you to prequalify and check your rates with a soft credit pull, which will not ding your credit score. There are also fintech companies that are reducing search frictions and price dispersion by making it easier to compare mortgages, auto loans, and unsecured personal loans.

Next time you get a mortgage, auto loan, or unsecured personal loan, do yourself a favor and invest just a few minutes of your time comparing prices. There is no upside to paying more than you have to for a loan. Just spending a few minutes comparing the loans you qualify for could save you thousands of dollars over the life of the loan.

Andrew Latham is the managing editor for SuperMoney and a certified personal finance counselor. He loves to geek out on financial data and translate it into actionable insights everyone can understand. His work is often cited by major publications and institutions, such as Forbes, U.S. News, Fox Business, SFGate, Realtor, Deloitte, and Business Insider.

Also Read: