Table of Contents

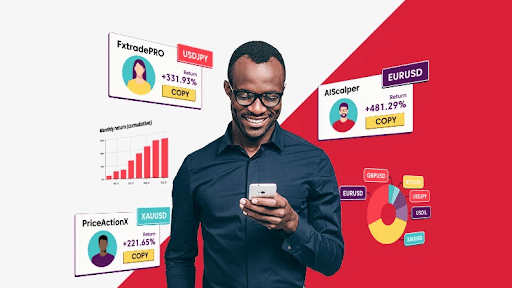

Futures trading and copy trading have emerged as two of the most popular trading tactics as cryptocurrency marketplaces develop into 2026. Automation is more important than ever, platforms are getting more advanced, and retail involvement is still increasing. But not every exchange is created equal, particularly when it comes to leverage and social trading. Choosing the wrong platform can quickly turn opportunity into unnecessary risk. Many traders now prioritize platforms positioned as a Top-tier trading platform with strong incentives when evaluating futures and copy trading options, as incentives, infrastructure, and risk controls increasingly matter.

This guide explains what traders should look for when choosing a crypto exchange for futures and copy trading in 2026.

Why Copy Trading and Futures Will Be More Important in 2026

While copy trading enables consumers to automatically follow seasoned traders, futures trading enables traders to bet on price fluctuations using leverage. When combined, they provide efficiency, accessibility, and flexibility, particularly in erratic or sideways markets.

These tactics are notable in 2026 because:

- The level of market volatility is still significant.

- Capital efficiency is what traders aim for.

- AI-assisted tactics are becoming commonplace.

- More people desire visibility without engaging in full-time trading.

As a result, exchanges have heavily invested in futures liquidity and social trading tools.

Key Criteria When Choosing a Futures Trading Exchange

Deep Liquidity and Tight Spreads

Liquidity is critical in leveraged trading.

High liquidity ensures:

- Lower slippage

- Faster order execution

- Reduced liquidation risk

An exchange with shallow order books can wipe out positions even when market direction is correct.

Robust Risk Management Systems

In 2026, quality futures platforms must offer:

- Adjustable leverage

- Isolated and cross margin options

- Clear liquidation price indicators

- Auto-deleveraging protection

Strong risk controls protect both beginners and experienced traders from sudden market spikes.

Competitive Fees and Funding Rates

Futures traders often overlook funding fees, but these costs accumulate quickly.

The best platforms offer:

- Low trading fees

- Transparent funding rate calculations

- Fee discounts via VIP tiers or incentives

Lower friction directly improves long-term profitability.

What Makes a Good Copy Trading Platform in 2026

Copy trading has evolved far beyond simple signal-following.

Transparent Trader Performance Metrics

A reliable copy trading platform should display:

- Long-term ROI

- Maximum drawdown

- Win/loss ratios

- Risk scores

- Trading history

This transparency helps users avoid blindly following traders with short-term luck.

Flexible Copy Settings

In 2026, users expect full control.

Advanced platforms allow:

- Fixed or proportional position sizing

- Max loss limits

- Stop-copy conditions

- Manual trade overrides

These tools reduce emotional trading while maintaining personal risk control.

Alignment of Incentives

The best platforms ensure that lead traders are rewarded based on sustainable performance, not reckless risk-taking.

Profit-sharing models should encourage consistency rather than aggressive gambling.

Security and Reliability Are Non-Negotiable

For futures and copy trading, platform stability is just as important as strategy.

Key security features to look for:

- Cold-wallet asset storage

- Proof-of-reserves or asset transparency

- DDoS protection during high volatility

- Account-level protections (2FA, withdrawal whitelists)

In 2026, downtime during major market moves is unacceptable.

User Experience Matters More Than Ever

Even advanced traders benefit from clean design.

A good platform should offer:

- Clear position dashboards

- Simple copy trading setup

- Mobile-friendly interfaces

- Fast order execution on both desktop and app

Complexity should come from strategy – not from navigating the platform.

Beginner vs Advanced: Choosing the Right Fit

Not all platforms serve the same audience equally.

Beginner-friendly platforms focus on:

- Lower default leverage

- Educational prompts

- Guided copy trading setup

Advanced platforms cater to:

- Custom leverage control

- API access

- Multi-account management

- Advanced order types

The ideal exchange grows with the trader, rather than forcing a platform switch later.

Common Mistakes Traders Make When Choosing an Exchange

Many traders focus only on:

- High leverage numbers

- Bonus promotions

- Short-term ROI screenshots

In reality, long-term success depends more on:

- Liquidity quality

- Risk controls

- Platform stability

- Transparency

Avoid platforms that emphasize marketing more than infrastructure.

Final Thoughts: How to Choose Wisely in 2026

Choosing a crypto exchange for futures and copy trading in 2026 requires more than chasing leverage or copying top-ranked traders. The best platforms combine deep liquidity, strong risk management, transparent copy trading systems, and reliable infrastructure.

For most traders, the smartest approach is to start conservatively, test copy trading features with small allocations, and gradually scale as confidence and understanding grow. In an increasingly competitive market, success often comes not from trading harder – but from choosing the right tools.

With the right exchange, futures and copy trading can become powerful components of a balanced crypto strategy in 2026.